Please see the latest news below

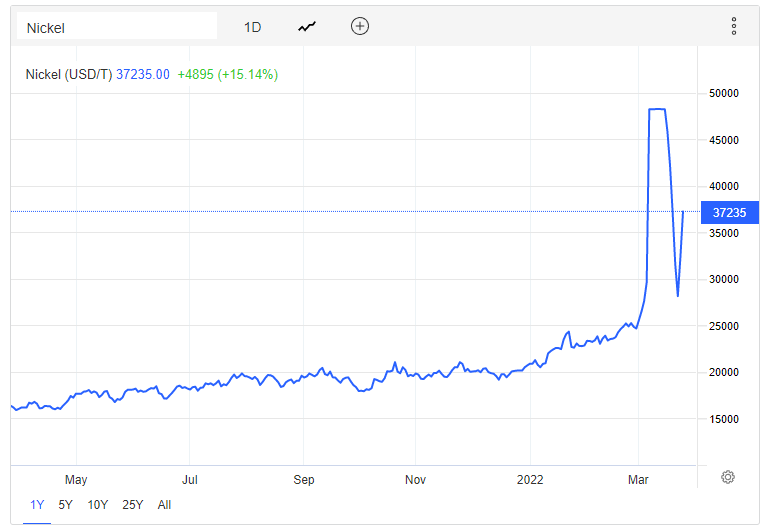

Breakneck volatility has returned to nickel markets, with the LME benchmark surging by the 15% exchange limit for the second straight day. Nickel futures are now changing hands around the $37,000-per-tonne level, having topped the $100,000 mark earlier this month amid a vicious short squeeze as China’s Tsingshan Holding Group, one of the world’s top producers, bought large amounts to hedge its short bets on the metal. Aside from the chaotic price action seen in the last couple of days, fundamentals in the nickel complex continue to be supported by Western sanctions against Russia over its invasion of Ukraine, which sparked concerns over the metal supply.

Welcome to contact us for more information.

Post time: Mar-25-2022